When it comes to being comfortable talking about money, building wealth, investment into our financial future, it can feel overwhelming if we are not equipped with the right tools from a young age. Unfortunately in the United States there is a growing gap between those who start life with all the best financial tools and support, and those who do not. But that is not the end of the story.

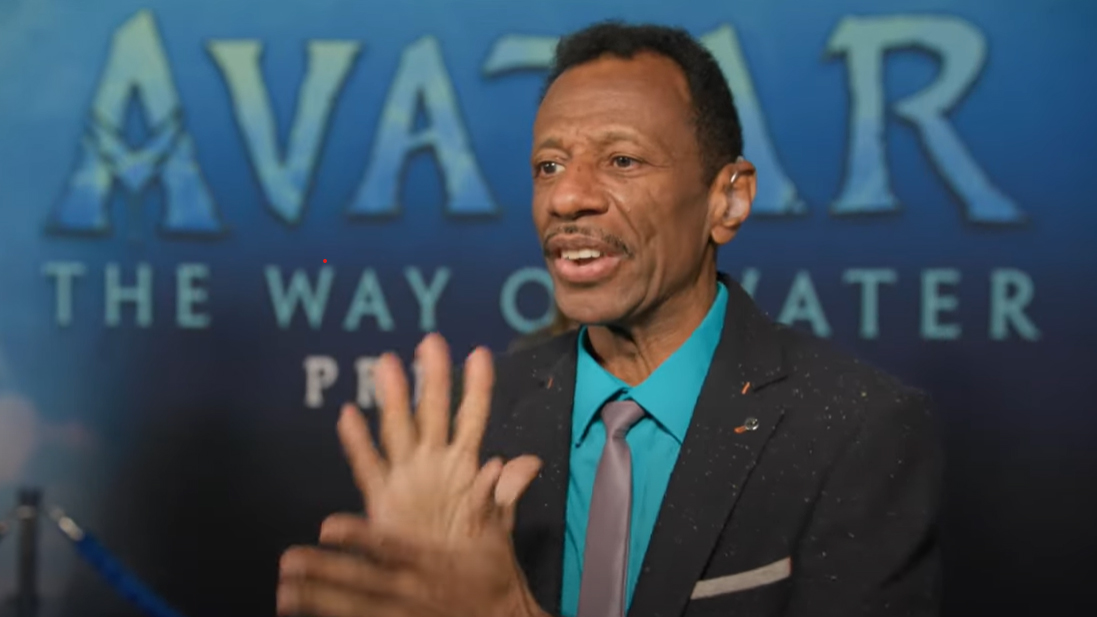

In fact, there are so many innovative organizations and people working to break the status quo and empower people to take control of their financial situation, and make learning about number and money fun. This is the case for Ashley Clark, the founder of Sense 2 Cents which is a board game and a company that allows parents and kids to learn about money in a fun way.

As the founder, Ashley is devoted to changing a family’s belief about money and breaks a generational financial curse for children of color through her company. Established in 2019, her products promote healthy learning habits and financial literacy. Through leveraging her financial expertise, she developed innovative products that are educational and entertaining for the youth and young adults.

Ashley is a firm believer that financial literacy and good financial habits, like any habit, should be instilled at a young age. It is important to learn the basics about money and good spending habits to manifest the right money mindset in adults.

Later when naming her company, she would choose a word play on cents, putting the common sense of financial literacy towards making some money. Sense 2 Cents has multiple resources and tools that families can use as learning activities. In an effort to make financial education fun and easy to understand, the company has produced vibrantly colored financial literacy flashcards, piggy banks, budget envelopes and a financial literacy activity book for children. The company also has educational ebooks and a 12-month budget planner available for purchase online.

We spoke with Ashley to learn more about how why she is passionate about focusing on communities and kids of color, and how we can start today building generational wealth, no matter where you are.

How did your company Sense 2 Cents first begin?

While working as a bank teller I unofficially starting my business years ago by helping friends with their budget and credit. As I helped my friends, I realized the lack of fundamental financial knowledge. I also heard the demand of adults in retrospect wishing they had financial knowledge as a kid. I am a firm believer that financial literacy and good financial habits, like any habit, should be instilled at a young age. It is important to learn the basics about money and good spending habits to manifest the right money mindset in adults.

This led me to provide age-appropriate learning materials for my children as I wanted to bridge the gap in education. During one of our sessions, I recorded a video of my financial homeschooling and posted in on Facebook. Overwhelmed with the response, people started requesting my flash cards and it naturally turned into my company, Sense 2 Cents. My next challenge was how to give real life scenarios where these terms would play out. It was then that the idea of the boardgame developed.

Can you tell us more about what the turning point in your life was, that made you passionate about empowering youth with financial literacy?

For 12 years I worked as a bank teller but it was after I left a job in a wealthy white neighborhood to join a new bank in town with more black and brown customers, I realized there was a lack of information that our people didn’t know. The move to the inner city was when I realized that there’s was a difference in the way that money was handled in the community. I remember being so underwhelmed with the common financial sense that surrounded the new neighborhood.

There I was bombarded with financial queries and I started writing down questions many people would ask. The journey started in my home teaching my kids but the need extended to families around me. Through leveraging my financial expertise, I developed innovative products that are educational and entertaining for the youth with products that promote healthy learning habits and financial literacy.

I decided to distribute my kid friendly tools and resources. My mission for the company is to deposit financial freedom into a child’s future and I remain devoted to changing a family’s belief about money and breaks a generational financial curse for children of color.

In the United States, your zip code, financial status and even race can often determine the type of education and empowerment you receive from a young age. How is Sense 2 Cents disrupting this status quo?

I want children to have access to valuable lessons that otherwise may not be available to them. Many minorities do not know how to teach these lessons because they have never been taught which is why I try to keep our tools simple, fun and so families can learn together.

For many people in the US (and the world!) the pandemic opened our eyes to the importance of being empowered financially. How can this period in our lives become a teaching moment for youth especially?

I’ve always talked about the importance of an emergency fund and now people see the need for it. This period can be a teaching moment for our kids especially. At about 2-4 you can start introducing the habit of saving. With a small piggy back. Saving is a great habit that when introduced early can make a big impact on one’s life.

For people who say they “hate math” or for kids who “don’t like numbers”, how is Sense 2 Cents making this area more fun and accessible?

Sense 2 Cents tries to make it simple and reach children at their level through flashcards and a boardgame. There is an amazing young lady named Brittany the CEO and founder of Black Girl MATHgic that is helping to bridge the gap between girls and math to let them know that math can be fun.

Can you talk more about how you are working to break generational financial setbacks for especially children of color?

I want children of color to know that although the statistics of financial inequality are grim. We can change it. Many of the reasons why we are in this prediction isn’t because we didn’t do better. We did not have the same opportunities as others but we can drastically change the way we think and handle our finances. Sense 2 Cents is a family game that instills knowledge in all.

What are some of the biggest tangible changes we see when youth (and by extension their families) become more financially literate and in control of their choices?

More opportunities for bigger investments and making wiser decision.

How can we start to have conversations around money that are less focused on capitalism and more focused on individual wellbeing and stability?

By thinking about generation wealth and how not only can our choices affect us positively now but for generations to come.

Can you share about your health journey with Multiple Sclerosis, and how you’ve dealt with this through the pandemic? And why it is important to ensure people have money saved for potentially unexpected health catastrophes in their lives?

It has been rough to be quite honest. I thought 2020 would be so much better for me after being diagnosed in 2019, but mentally running a business and getting used to my diagnosis and choosing treatment was a major part of my year and I’m still dealing with it. Being insured and keeping cash saved is again ideal for times when we need to use our emergency fund. It makes life easier when you don’t have to worry about the burden of the cost of your financial well-being when it effects your health which could cost mental strain in other circumstances.

What are your goals for 2021, and how would you empower others to look ahead despite the continued uncertainty of COVID-19?

As a community we are in a place where we can change the way we think about how we want to move forward. A lot of people are now paying attention and open to being the change.

Learn more about financial literacy and Sense 2 Cents by clicking HERE.